Choosing the right online payment system is a massive decision for any small business. Think of it as your digital till—the engine that securely takes money from your customers and gets it safely into your bank account. For any modern UK business wanting to accept payments online, from debit and credit cards to digital wallets, getting this right is non-negotiable.

It's the digital handshake between your customer's bank and yours, making sure the money moves smoothly and securely every single time.

What Are Online Payment Systems?

At its simplest, an online payment system is the tech that lets you take electronic payments for your products or services over the internet. But it's so much more than just a way to get paid. It's a critical piece of your business's machinery, handling everything from data encryption and security to the complex chat between all the different banks involved.

Imagine a customer lands on your website and decides to buy something. The moment they enter their card details, your payment system kicks into gear. It acts like a highly secure, automated courier, grabbing that sensitive payment info, checking it's all legitimate, and making sure the funds are transferred correctly.

The Key Players in Every Transaction

To really get your head around how it all works, it helps to know who’s involved behind the scenes. Every single sale you make online is a coordinated dance between four key players:

- The Customer: The person making the purchase with their card or digital wallet.

- Your Business (The Merchant): That's you, the seller who needs to receive the cash for what you've sold.

- The Payment Gateway: This is the secure bit of tech that snags the customer's payment details from your site, encrypts them, and sends them off to be authorised.

- The Banks: This includes the customer’s bank (the issuing bank) and your business's bank (the acquiring bank). They talk to each other to approve the transaction and move the money.

At its core, an online payment system is the digital infrastructure that connects all these players, making the complex process of transferring money seem instant and effortless to the customer. This seamless experience is vital for building trust and encouraging repeat business.

Why It Matters for Your Small Business

For a small business, picking the right system isn't just a technical choice—it's a commercial one. A reliable system means you get paid on time, every time. A clunky one leads to lost sales and seriously frustrated customers. As you start looking at your options, you’ll come across different bits of terminology, and our guide to the best payment gateway for small business can help clear up the jargon.

On top of that, it's worth keeping an eye on new ways to make paying even easier for your customers. Modern solutions like Text to Pay options are popping up, offering incredible convenience for certain types of businesses. At the end of the day, the goal is to create a checkout that feels secure, fast, and builds confidence, turning casual visitors into loyal customers.

How Customer Payment Trends Impact Your Sales

Failing to offer the right payment options is like having a shop with a locked door—potential customers will just turn away and find somewhere else to spend their money. Understanding how UK shoppers prefer to pay isn't a minor technical detail; it's a fundamental part of your sales strategy.

When your online checkout aligns with your customers' habits, you smooth out the whole buying process, build trust, and ultimately, you'll turn more visitors into buyers. Today's shoppers have high expectations. A clunky or limited payment page is one of the quickest ways to lose a sale, as people now expect instant, seamless transactions whether they're using a debit card, a digital wallet like PayPal, or paying directly from their phone.

The Dominance of Cards and Digital Wallets

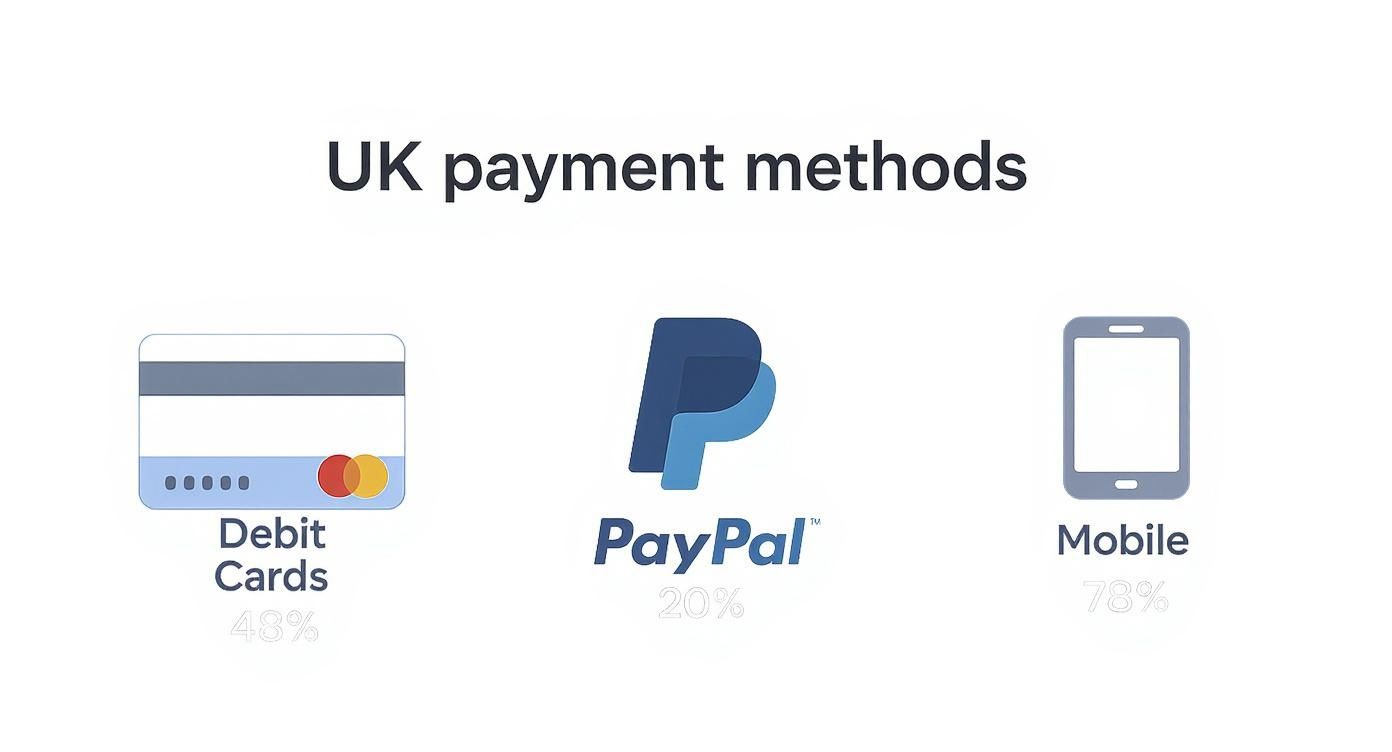

In the UK, the old reliables still hold serious ground. Debit and credit cards, especially Visa and Mastercard, are the bedrock of e-commerce. In 2023, a staggering 97% of UK online stores accepted them, making card payments absolutely non-negotiable for any small business.

Alongside cards, digital wallets have become just as essential. PayPal, for instance, is a household name that gives customers a layer of security and convenience they’ve come to rely on. By offering these familiar, trusted options, you instantly signal that your business is credible and secure—a vital step in winning over a new customer.

This image gives you a clear snapshot of how UK consumers are paying online, showing exactly where their preferences lie.

This simple breakdown of UK online payment habits helps businesses understand which options are non-negotiable for their checkout process.

UK Consumer Online Payment Preferences

| Payment Method | Percentage of Online Transactions | Key Consumer Group |

|---|---|---|

| Debit Cards | 48% | The majority of UK shoppers; a must-have. |

| Credit Cards | 26% | Frequent online shoppers, often for larger purchases. |

| PayPal | 20% | Security-conscious buyers and mobile shoppers. |

| Mobile Wallets | Growing Rapidly | Younger demographics (e.g., Apple Pay, Google Pay). |

Offering the top three—debit cards, credit cards, and PayPal—ensures you're catering to 94% of the market's preferences right out of the gate.

The Rise of Mobile Payments

The shift towards mobile commerce is undeniable, especially among younger shoppers. In 2023, an incredible 78% of UK adults aged 16-24 used mobile payment methods. This isn't just about accepting payments from a phone; it's about making sure your entire checkout experience is slick and easy to use on a smaller screen.

Offering a variety of payment methods is no longer a luxury—it's an expectation. By catering to diverse preferences, you widen your potential customer base and significantly reduce the risk of cart abandonment, a common hurdle for many small online businesses.

The growth in online retail has been massive. Between 2013 and 2022, UK internet retail sales exploded from £33.4 billion to £116.8 billion. While small businesses saw their online sales grow to £26.4 billion, their overall market share dipped slightly in 2022, signalling just how fierce the competition is. To stay in the game, you have to nail the basics, and that means prioritising the payment methods customers actually use. You can read more about the latest UK payment statistics on Airwallex.com.

By understanding and adapting to these trends, you can fine-tune your payment strategy. This ensures you're not just processing transactions but actively creating a better customer experience that can directly increase your e-commerce sales.

Understanding Payment System Costs And Fees

Let's talk about the real cost of getting paid. The headline rate you see advertised for an online payment system for small business is rarely the full story. To protect your profit margins, you have to look past the shiny numbers on the surface and get to grips with the complete fee structure.

Think of it like this: your payment provider is like a courier service for your money. There’s a basic charge to get it from A to B, but extra fees can pop up for fuel, special handling, or insurance. These costs chip away at your bottom line, so understanding how they work is non-negotiable for keeping your finances healthy.

Breaking Down Transaction Fees

The most common charge you'll run into is the transaction fee. This is a small slice taken from every single sale you make. Typically, it’s a mix of a percentage of the total sale plus a tiny fixed fee. A standard rate you'll see in the UK is something like 1.4% + 20p for European cards.

On its own, it doesn't sound like much. But as your sales grow, those little percentages add up fast, eating directly into the profit of every item you sell.

The key takeaway for any small business owner is that transaction fees are unavoidable, but they are not all created equal. Understanding the different pricing models is the first step towards choosing the most cost-effective solution for your business.

Providers usually offer one of two main pricing models. Each has its pros and cons, and the right one for you really depends on your sales patterns.

- Flat-Rate Pricing: This is the simple, no-fuss option. You pay one predictable percentage and a fixed fee for every transaction, no matter what kind of card your customer uses. Providers like Stripe and Square love this model because it’s transparent, which is a godsend for startups that need straightforward financial forecasting.

- Interchange-Plus Pricing: This one’s a bit more complex, but it's often cheaper for businesses with a higher sales volume. It splits the fee into two bits: the 'interchange' fee (a wholesale rate set by card networks like Visa) and the 'plus' markup (the processor’s profit). It’s less predictable month-to-month but can lead to big savings as you scale.

Beyond The Transaction: The Hidden Costs

While transaction fees are the most obvious expense, a few other costs can catch you by surprise if you’re not careful. These potential “hidden” fees can vary wildly between providers, so it’s absolutely vital to read the small print before you sign anything.

Keep an eye out for these common extras:

- Monthly Fees: Some providers charge a regular subscription just for access to their gateway or to keep your merchant account active.

- Setup Fees: A one-off charge to get your account up and running. This is becoming rarer with modern processors, but it still exists.

- Chargeback Fees: If a customer disputes a transaction and you lose, the provider will hit you with a penalty fee—usually around £15-£20—on top of having to refund the sale. Ouch.

- PCI Compliance Fees: Some processors charge an annual fee to cover the admin of keeping you compliant with the Payment Card Industry Data Security Standard (PCI DSS).

Choosing the right payment system goes hand-in-hand with your sales platform. For more on that, our breakdown of the best e-commerce platform for small business has some great insights to help you make a smart, integrated decision. Taking the time to compare these fee structures now will ensure you pick a partner that helps you grow, rather than one that just drains your profits.

Essential Features Your Business Needs To Grow

A modern payment system is far more than just a digital till; it's a powerful toolkit designed to help your small business expand. The right features don't just process sales—they open up new markets, create predictable revenue streams, and give your customers the flexibility they demand. Moving beyond basic card acceptance is essential for growth.

Think of these advanced features as upgrades to your business engine. Basic functionality gets you moving, but adding these components can boost your speed, efficiency, and reach. By carefully selecting which ones you need, you can build a payment setup that actively supports your ambitions, rather than just keeping up with them.

Reaching Customers Around The World

If you have ambitions to sell beyond the UK, multi-currency support is a non-negotiable feature. It allows you to display prices and accept payments in a customer's local currency, such as Euros or US Dollars. This simple change dramatically improves the international customer experience, as it removes the confusion and uncertainty of exchange rates.

For a Scottish business selling handmade crafts online, this could mean a customer in Germany sees the price in Euros and pays that exact amount. Your payment system handles the conversion behind the scenes, so you receive the payment in pounds without any extra hassle. It makes your business feel local to a global audience.

Offering multi-currency payments can increase international sales by making your pricing clear and trustworthy. It removes a significant barrier to purchase for overseas customers, helping you tap into new markets with confidence.

Creating Predictable, Recurring Revenue

For businesses built on subscriptions, memberships, or regular service retainers, recurring payments are the foundation of your model. This feature automates the process of billing customers at set intervals—weekly, monthly, or annually—without requiring them to re-enter their payment details each time.

It's the mechanism that powers everything from a monthly coffee subscription box to a software-as-a-service (SaaS) plan. By automating billing, you secure a predictable cash flow, reduce the administrative burden of chasing invoices, and massively cut down on customer churn caused by missed payments.

Meeting Modern Consumer Expectations

One of the most significant shifts in online payments has been the rise of Buy Now, Pay Later (BNPL) services like Klarna and Clearpay. These options allow customers to split the cost of a purchase into smaller, interest-free instalments, making higher-priced items feel more affordable.

Integrating BNPL can significantly boost your average order value and conversion rates, especially for retailers selling items like furniture, electronics, or high-end fashion. It gives customers the financial flexibility they've come to expect, turning a hesitant browser into a confident buyer. Incorporating these modern payment tools is just one of many essential features of a website designed for growth.

Exploring Innovative Payment Methods

A newer but rapidly growing option in the UK is Open Banking. This technology enables customers to pay you directly from their bank account, bypassing traditional card networks entirely. The result is a highly secure transaction with significantly lower processing fees for your business.

Recent data shows just how quickly this method is catching on. As of March 2025, around 13.3 million UK users—a mix of consumers and small businesses—are actively using open banking, with some e-commerce merchants reporting transaction growth of up to 500% after adoption.

While it's still gaining traction, its potential for cost savings makes it a compelling feature for any forward-thinking small business. You can find more detailed figures by exploring the latest insights on open banking adoption from The Payments Association. Choosing a system with these capabilities prepares your business for the future of digital payments.

Navigating Security And Compliance Requirements

When you start taking payments online, you're not just handling money anymore. You're also responsible for your customers' sensitive financial data. It's a huge responsibility, but the good news is you don't have to go it alone. Modern online payment systems for small business are built with security at their core, taking the heavy lifting of compliance off your shoulders so you can focus on your customers.

Think of these security standards as the digital version of having high-security locks and a certified vault in a physical shop. They are non-negotiable rules designed to keep everyone's data safe from fraudsters. Understanding the basics is essential for building trust and protecting your business's reputation.

Understanding PCI DSS

The absolute cornerstone of payment security is the Payment Card Industry Data Security Standard (PCI DSS). This is a set of mandatory rules created by the big card networks (like Visa and Mastercard) that every single business accepting card payments has to follow. Its one and only purpose is to clamp down on credit card fraud by strictly controlling how cardholder data is stored, processed, and sent.

For a small business, trying to become fully PCI compliant on your own would be a complex and expensive nightmare. Thankfully, this is where your payment provider becomes your most important partner.

By using a reputable, PCI-compliant payment gateway, you're effectively outsourcing the hardest parts of security. These providers invest a fortune in secure infrastructure, making sure that sensitive card details never even touch your website's server. This massively reduces your compliance burden.

What this really means is that when a customer types their card number on your site, that data is handled directly by the Fort Knox-like systems of providers like Stripe or PayPal, keeping both you and your customers safe.

The Role Of Strong Customer Authentication

For any business in the UK and Europe, another critical layer of security is Strong Customer Authentication (SCA). This regulation was brought in to make online payments safer by requiring customers to provide an extra bit of verification before a payment is approved. It's all about proving that the person making the purchase is genuinely the cardholder.

SCA usually requires a customer to prove their identity using at least two of the following three methods:

- Knowledge: Something only they know (like a password or PIN).

- Possession: Something only they have (like their mobile phone to get a one-time code).

- Inherence: Something they are (like a fingerprint or facial recognition).

You’ve almost certainly run into this yourself when your bank asks you to approve an online purchase through its mobile app. Modern payment systems handle this whole process automatically, triggering the necessary checks without you needing to configure a thing. This doesn't just cut down on fraud; it also gives customers more confidence at checkout.

Key Security Technologies That Protect Your Business

Behind the scenes, your payment provider is using some seriously clever technology to protect every single transaction. The two most important bits of tech you should know about are encryption and tokenization.

Encryption works by scrambling card data into an unreadable code the second it leaves the customer’s browser. This ensures that even if a criminal somehow managed to intercept the data on its journey to the payment processor, it would be completely useless to them.

Tokenization takes this a step further. Instead of storing the sensitive card details, it replaces them with a unique, non-sensitive identifier called a "token." This token can be safely stored for things like recurring payments or saved customer profiles without ever exposing the actual card number, providing a powerful layer of long-term protection.

Integrating A Payment System With Your Website

Alright, this is the final, crucial step: connecting your chosen online payment system for small business to your website. Think of it as installing the digital till in your new shop. Getting this right is what turns a casual browser into a paying customer.

You’ve got two main ways to go about this, each with its own trade-offs in terms of simplicity, branding, and the experience you give your customers. The path you pick will come down to your technical confidence, what e-commerce platform you're using, and just how much control you want over that final checkout moment.

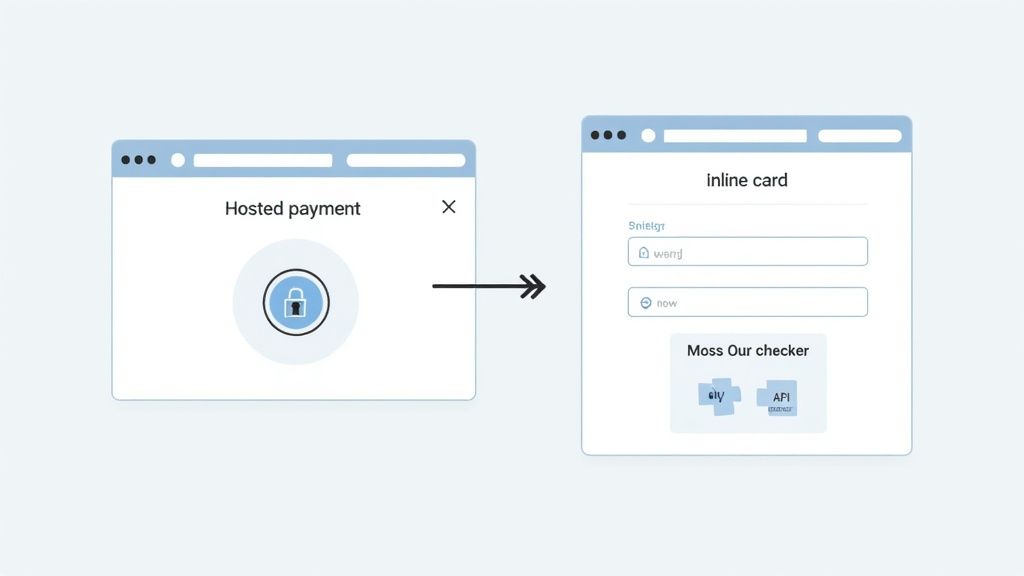

Hosted Payment Pages: The Simple Start

The most straightforward way to get up and running is with a hosted payment page. When your customer is ready to buy, they click 'Pay Now' and are whisked away from your website to a secure page hosted by your provider—think Stripe or PayPal. Once the payment is done, they’re sent right back to your site.

- Pros: It’s incredibly easy and fast to set up, often needing zero coding skills. Your payment provider handles all the tricky security and PCI compliance, taking a huge weight off your shoulders.

- Cons: The biggest drawback is the slight break in your brand's flow. Sending customers to another website can feel a bit disjointed and might put a few people off if the transition isn't super smooth.

Integrated Checkouts: A Seamless Experience

For a more polished and professional feel, an integrated checkout is hands-down the better choice. With this method, the entire payment process happens right there on your website. Your customers enter their card details into a form embedded on your checkout page, and they never, ever leave your domain.

This is done using something called an API (Application Programming Interface), which is just a fancy way of saying your website can talk securely to the payment processor behind the scenes. And while it sounds technical, most modern e-commerce platforms do all the heavy lifting for you.

An integrated checkout creates a frictionless, trustworthy experience that keeps your brand front and centre. This seamless journey is proven to boost customer confidence and increase the likelihood of a completed sale.

If you’re running on a platform like Shopify or WooCommerce, this is pretty much the standard. They have pre-built integrations with all the major payment providers, making a professional, on-site checkout surprisingly simple to set up. Our guide on how to create an online store walks through more of these practical steps.

A key benefit here is the knock-on effect on your cash flow. Late payments are a nightmare for UK businesses; a recent report found that a staggering 62% of UK small businesses are owed money from overdue invoices. A slick online payment system helps you get paid faster, cutting down on the stress of chasing money.

If your website is a custom build, an API gives you total flexibility to create a completely bespoke customer journey. And for businesses that rely on QuickBooks Online, a good guide to integration with QuickBooks Online can make connecting your payment system a breeze.

Whether you opt for a hosted page for its sheer simplicity or an integrated API for a superior customer experience, the end goal is always the same: make it as easy as possible for people to give you their money.

Frequently Asked Questions

Jumping into the world of online payments always throws up a few practical questions. It’s completely normal. Here are some clear, straightforward answers to the queries we hear most often from business owners, helping you get your head around the day-to-day realities of managing your money online.

How Quickly Do I Get My Money?

This is the big one, isn't it? For any small business, cash flow is king. The time it takes for money from a customer's purchase to actually land in your bank account is called the settlement period, and it can vary quite a bit between different providers.

Typically, you can expect the funds to arrive within 1-3 business days. The newer, all-in-one players like Stripe or Square are usually at the faster end of that scale. It's absolutely crucial to check the specific settlement times of any provider you're considering, as some might offer faster options—even same-day funding—for an extra fee. Just remember that weekends and bank holidays will always slow things down a bit.

What Happens If a Customer Disputes a Payment?

When a customer challenges a transaction with their bank, it triggers something called a chargeback. This can happen for all sorts of reasons, from genuine fraud right through to a customer simply not recognising your business name on their bank statement.

If a chargeback happens, the disputed funds are immediately pulled from your account while the bank investigates. Your payment provider will notify you and give you a window to submit evidence to prove the transaction was legitimate—things like proof of delivery or your email communications with the customer.

It's so important to respond to chargeback requests quickly and with clear evidence. If you lose the dispute, you don't just lose the sale amount; you'll also get hit with a chargeback fee, usually around £15-£20. Keeping good records is your best defence.

Can I Switch Payment Providers Easily?

Yes, for the most part, you can. Modern payment systems, especially the ones with simple flat-rate pricing and no lock-in contracts, make it relatively straightforward to move your business somewhere else if you're not happy or your needs change.

However, there are a few things you need to keep in mind before you make the jump:

- Contracts: Double-check your current agreement for any early termination fees. They’re less common now, but some traditional merchant account providers still use them.

- Data Portability: This is a big one for subscription businesses. If you have customers with saved card details for recurring payments, you have to make sure your current provider lets you securely transfer that tokenised data to the new one.

- Integration: You’ll need to go through the technical steps of integrating the new provider with your website, whether that’s installing a new plugin or updating some code.

Switching is definitely doable, but it needs a bit of careful planning to make sure it’s a smooth transition that doesn’t interrupt your ability to get paid.

Ready to build a high-performing website with a seamless, secure payment system built right in? At Altitude Design, we create custom, hand-coded websites for Scottish businesses that are fast, reliable, and designed to convert. Find out how we can help your business grow online.